Sage Intacct Integration: Scaling Smarter - Top 5 Pitfalls to avoid

Are you ready to supercharge your business operations?In today’s fast-paced business environment, organizations often turn to cloud-based financial management solutions like Sage Intacct to streamline their operations, gain better financial insights, and support their growth. While adopting such a powerful tool is a step in the right direction, ensuring its seamless integration with existing systems is crucial.

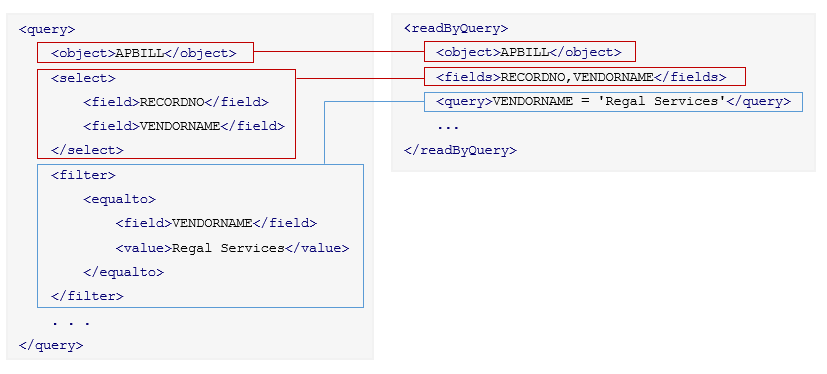

To future-proof your organization in an increasingly competitive and constantly changing business landscape, you must embrace adaptability through a flexible architecture and the utilization of APIs. With data scattered across various platforms, it’s essential to ensure your infrastructure can scale dynamically and seamlessly integrate with diverse components.

For most companies, the finance system is the hub for all of the other systems they use. It becomes a go-to point for making strategic decisions that affect the rest of the company. Sage Intacct can leverage financial integrations to eradicate data rekeying, facilitate seamless information sharing across teams and departments, and generate actionable insights for quicker and more informed decision-making. However, integrating such a crucial system into your organization’s infrastructure requires careful planning and execution to avoid potential pitfalls that could hinder growth and productivity.

In this article, we’ll discuss the top five pitfalls to avoid when planning financial integrations with Sage Intacct along with real-life examples to illustrate these challenges.

Contents

Pitfall #1 Poor Planning & Strategy

One of the primary pitfalls in Sage Intacct integration is inadequate planning and strategy. Rushing into integration without a clear plan can result in chaos and disruptions to existing processes. It’s crucial to have a well-defined integration strategy that aligns with your organization’s goals and objectives. Imagine a rapidly growing e-commerce company decided to integrate Sage Intacct without thoroughly understanding its current processes and future requirements. The integration was rushed, causing data inconsistencies and delays in financial reporting. This disrupted financial visibility and strained decision-making, ultimately slowing down growth.

Another example would be if a hotel chain integrated Sage Intacct with their CRM system without a proper integration plan. They would soon find that the two systems did not communicate effectively, leading to incorrect customer data and lost sales opportunities. They wouldn’t be able to realize the full potential of Sage Intacct without a well-thought-out integration strategy. We recommend you start by outlining your integration goals, mapping the data flow, and considering the potential bottlenecks. Invest in a well-documented integration plan to ensure a smooth process.

Pitfall #2 – Poor Data In, Poor Data Out

Effective data mapping is a critical component of integration. Inadequate or inaccurate data mapping can lead to data inconsistency, incomplete records, and misreporting. Frequently, teams overseeing Sage Intacct implementation can tend to focus more on the new features and leave data cleanup as a low priority. However, this approach can potentially introduce delays during the implementation process. Neglecting the cleanup of duplicate or poor data can result in inaccurate forecasts and insights that will confuse your team and cause unnecessary downtime to resolve.

Another point to consider is to avoid clogging workflows with too much information. When dealing with a substantial volume of consumer sales, the question arises: Should you retain each customer record within your core financial system, or would it be more practical to maintain these specifics within the point-of-sale system and have the financial system primarily manage summarized transactions? A robust financial system should offer flexibility through custom data tables or objects, enabling you to house a significant portion of this data in the primary financial record system, with only summary data being transmitted to the tables that contribute to the general ledger.

For example, a retail company integrated Sage Intacct with its e-commerce platform but failed to properly map product SKUs. As a result, sales data from the online store did not align with the accounting records, leading to incorrect revenue recognition and inventory management.

Another example is a manufacturing company integrated Sage Intacct without addressing data quality issues in their existing systems. As a result, the financial data transferred was riddled with errors, leading to incorrect financial statements and misinformed business decisions.

Invest time in thorough data mapping. Ensure that data fields from different systems are properly aligned, and there’s a clear understanding of how information should flow between systems. Engaging a Sage Intaact integration expert can guarantee that thorough data auditing and data mapping take place before implementation, ensuring optimal outcomes. Need help with your Sage Intaact Integration? Click here to speak with an expert today.

Pitfall #3 – Insufficient Testing & Validation

Data validation is the process of ensuring that the integrated data is accurate and reliable. Neglecting this step can lead to costly mistakes and regulatory compliance issues. Testing and ongoing monitoring are essential for identifying and resolving issues in the integration process. Skipping these steps can result in hidden problems that may only surface when it’s too late.

For example, a software development company integrated Sage Intacct with its project management system but did not establish a testing and monitoring framework. As a result, unnoticed errors in time tracking and resource allocation led to project cost overruns and customer dissatisfaction. Another example is a healthcare organization integrated Sage Intacct with its patient billing system but did not implement validation checks for insurance information. This led to frequent errors in claims submissions, payment delays, and compliance violations.

As integration experts, we cannot emphasize the importance of data testing enough. It is crucial to ensuring a smooth and successful system integration.

Need a developer?

We can help.

Pitfall #4 – Not Engaging The End User

A successful Sage Intacct implementation depends on adequate employee training. Sage is a powerful solution, but you won’t capitalize on the benefits if users don’t know how to use the system. Inadequate training and user adoption can thwart the success of the integration. Users must be well-trained to effectively utilize the integrated system, ensuring maximum efficiency and ROI. If a company integrated Sage Intacct without consulting their end-users, the result would be a system that was difficult to navigate leading to decreased productivity and employee frustration.

Here’s another example: a retail company integrated Sage Intacct with its inventory management system but failed to adequately train its employees. Consequently, the staff struggled to navigate the integrated system, causing delays in order processing and inventory inaccuracies.

We recommend involving end-users from various departments in the integration process. Their insights are invaluable for creating a user-friendly interface and ensuring that the integrated systems meet their needs.

Pitfall #5 – Neglecting Scalability & Future Growth

After successful integration, a t-shirt manufacturing company assumed their job was done. However, as their business evolved, the integration became outdated and inefficient, causing operational disruptions and financial inaccuracies. Failing to consider scalability and future growth can lead to costly and time-consuming rework as your business expands. The integration should be designed to accommodate increased data volumes and additional functionalities.

Another example is a software startup integrated Sage Intacct, but the integration was not designed to handle the exponential growth in customer transactions. This oversight resulted in system slowdowns and inefficiencies, impeding the company’s ability to scale rapidly.

In Conclusion…

Sage Intacct integration can be a game-changer for businesses looking to streamline their financial operations and scale efficiently. However, avoiding the aforementioned pitfalls is essential for a successful integration process. By planning meticulously, mapping data correctly, validating data, engaging end users, and implementing testing and monitoring procedures, companies can achieve a seamless Sage Intacct integration that empowers them to scale smarter and reap the full benefits of their financial software.

Our team of developers are experts in Sage Intacct integrations and can optimize the system to best work for your business needs.

Give us a call on 303.473.4000 or click here to get in touch.

Stay tuned for more…

Jeff

Busy running your business? We can help..

Developers who care. Code that works. Our team of programmers are here to help you with all of your system integration needs. Click here to start your free consultation today.

READY TO START GROWING YOUR BUSINESS?

Schedule a free, No Obligation Consultation about our Digital Marketing Services

let’s start marketing

Say Hello!

We would love to discuss your project with you. Get in touch by filling out the form below and we’ll contact you asap. Want to speak to a human now? Text or call 303.473.4400